30+ mortgage points tax deduction

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. If you paid mortgage points and youve determined that you qualify for a.

Serving The Citizens Not The Bureaucracy A Strategic Vision For City Procurement Digital Benefits Hub

How to Deduct Mortgage Points on Your Taxes.

. Ad 5 Best Home Loan Lenders Compared Reviewed. Web For example if your mortgage points totaled 5000 and you took out a 15-year fixed youd be able to deduct roughly 333 annually 5000180 months 2778 x. Private mortgage insurance Not so great news.

Ad CNB provides tax-exempt financing designed to help you achieve your business goals. Web Most homeowners can deduct all of their mortgage interest. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent.

If the loan term is 30 years or less terms over 10 years have to be. Lets assume that their tax rate is 25. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

Web 1 hour agoIn the fourth quarter of fiscal 2023 which ended on Jan. Web I entered the dollar amount of mortgage points paid over 1000 but the deduction allowed is only 30. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Put our experience to work for you. Web You can deduct the points in full in the year you pay them if you meet all the following requirements. Your main home secures your loan your main home is the one.

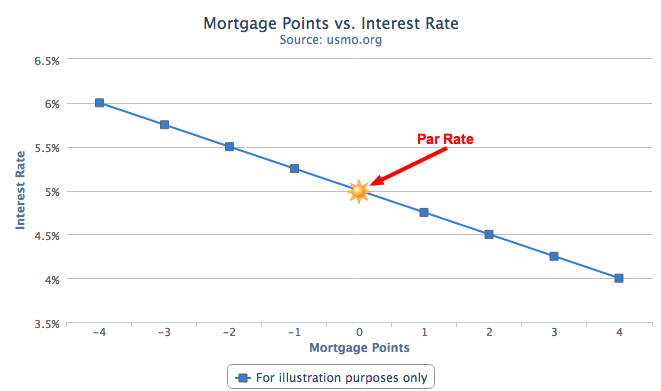

The standard deduction for a. Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Homeowners who are married but filing.

Web It is possible to deduct mortgage points over the life of your home loan if you meet the following criteria. Web Dow 30-18161 -054 Nasdaq-129. A couple with a 400000 mortgage at 4 is paying about 16000 of mortgage interest.

29 the chipmakers revenue dropped 21 year over year to 605 billion but cleared analysts expectations. Taxes Can Be Complex. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Taxes Can Be Complex. Compare Lenders And Find Out Which One Suits You Best.

Web He paid three points 3000 to get a 30-year 100000 mortgage and he made his first mortgage payment on Jan. If I must deduct points over the life of my mortgage and I have a 30-year mortgage. Learn how City National Bank can help you grow.

Comparisons Trusted by 55000000. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. For 2018 his itemized deductions including.

Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000. Web Here is an example of how discount points can reduce costs on a 400000 30-year fixed-rate mortgage with 20 percent down. Why is this the case.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Here is an example of what will be the scenario to some people. Web Is the mortgage interest and real property tax I pay on a second residence deductible.

Looking For Conventional Home Loan. Mortgage discount points are tax.

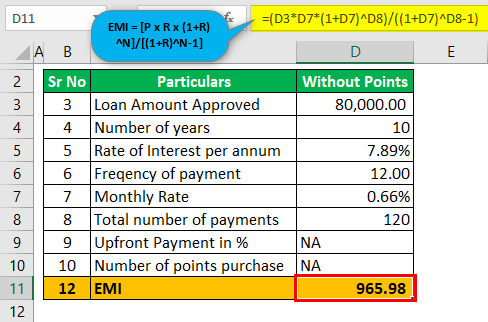

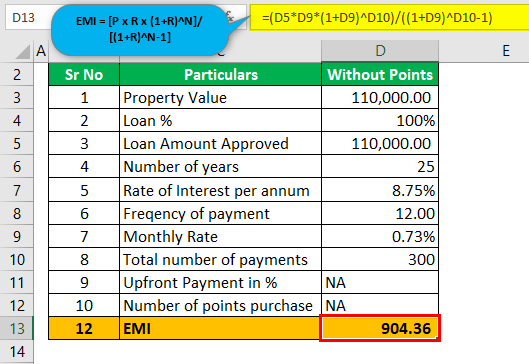

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Calculate Emi With Without Points

Maximizing Linkages A Policymaker S Guide To Data Sharing Digital Benefits Hub

Google Launches Play Rewards Programme In India The Economic Times

Mortgage Interest Tax Deduction What You Need To Know

Can I Deduct The Buy Down Points On A Mortgage Credit

Understanding Mortgage Points U S Mortgage Calculator

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

G382501ka07i009 Gif

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How To Deduct Mortgage Points On Your Taxes Smartasset

Are Mortgage Points Tax Deductible

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

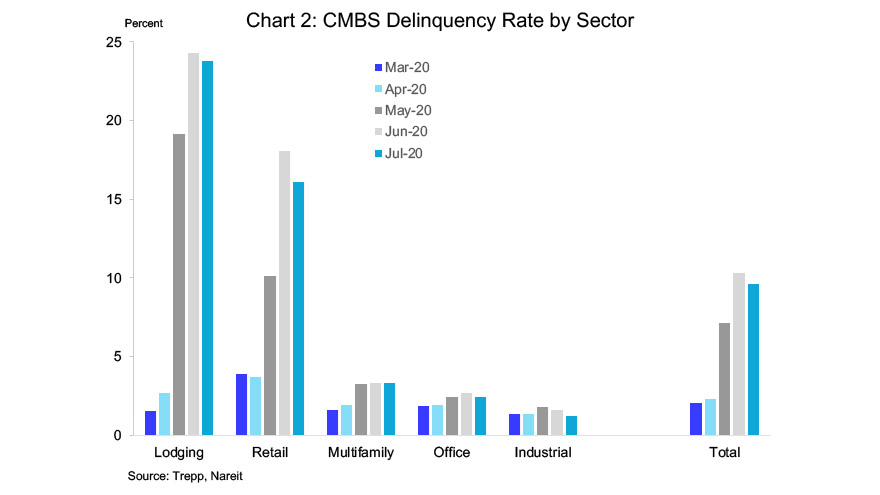

Cbms Delinquency Rate Drops In July Nareit

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Credit Cracks Starting To Emerge For Kiwi Consumers Centrix Says Interest Co Nz